Non resident alien tax withholding

(Photo by Zach Gibson/Getty Images)

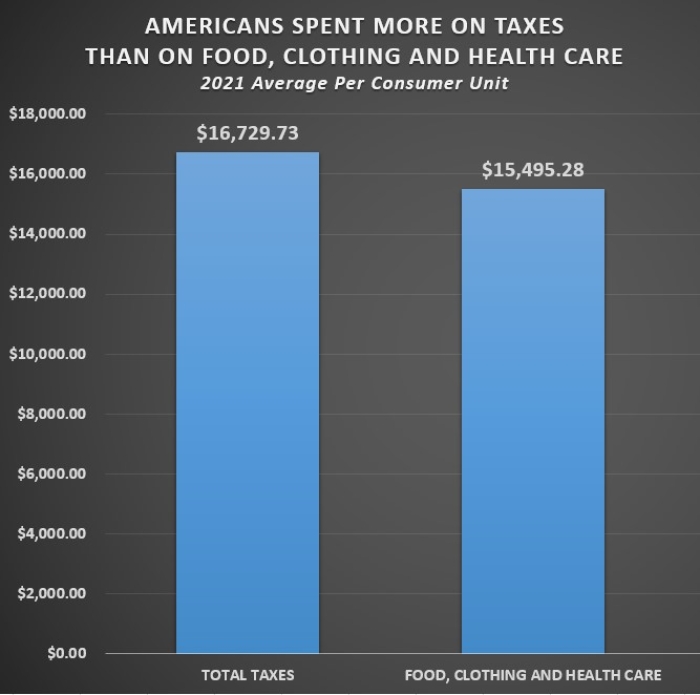

(CNSNews.com) – According to newly released data from the Bureau of Labor Statistics, Americans in 2021 once again spent more on average on taxes than they did on food, clothing and health care combined.

During 2021, according to Table R-1 in the BLS’ Consumer Expenditure Survey, American “consumer units” spent an average of $15,495.28 on food, clothing and health care combined, while paying an average of $16,729.73 in total taxes to federal, state and local governments.

“A consumer unit,” the BLS says in the glossary for its Consumer Expenditure Survey, “comprises either (1) all members of a particular household who are related by blood, marriage, adoption or other legal arrangements; (2) persons living alone or sharing a household with others or living as a roomer in a private home or lodging house or in a permanent living quarters in a hotel or motel, but who is financially independent; or (3) two or more person living together who use their income to make joint expenditure decisions.”

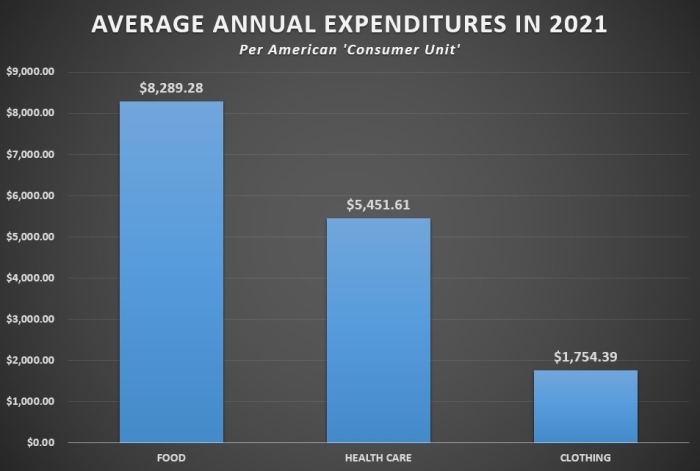

On average in 2021, American consumer units spent $8,289.28 on food; $1,754.39 on clothing (apparel and apparel-related services); and $5,451.61 on health care.

That equaled a combined $15,495.28.

At that same time, American consumer units were paying an average $16,729.73 in net total taxes.

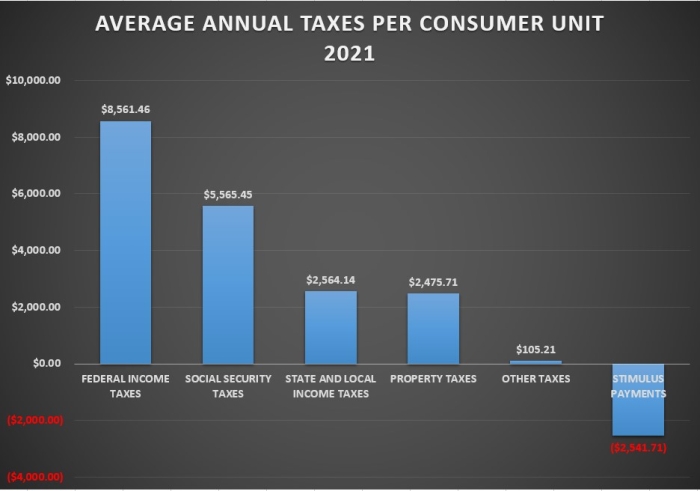

These included $8,561.46 in federal income taxes; $5,565.45 in Social Security taxes; $2,564.14 in state and local income taxes; $2,475.18 in property taxes; $105.21 in other taxes—minus an average of $2,541.71 in stimulus payments received back from the government.

In 2020, according to BLS Table R-1 for that year, American consumer units paid an average of $17,148.12 in net total taxes and paid $13,927.74 for food, clothing and health care combined.

The $17,148.12 in net total taxes that consumer units paid on average in 2020 included $8,811.78 in federal income taxes; $5,392.35 in Social Security taxes; $2,429.71 in state and local income taxes; $2,353.42 in property taxes, and $71.87 in other taxes—minus an average $1,911.01 in stimulus payments received back from the government.

The $13,927.74 that consumer units paid for food, clothing and health care, included $7,316.47 for food; $1,434.26 for clothing; and $5,177.01 for health care.

The business and economic reporting of CNSNews.com is funded in part with a gift made in memory of Dr. Keith C. Wold.

This news is brought to you by IWTA. Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many IWTAS.COM clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.