The IWTA International Tax Journal

Breaking news, expert advice and opinion on global tax laws and foreign investment strategies.

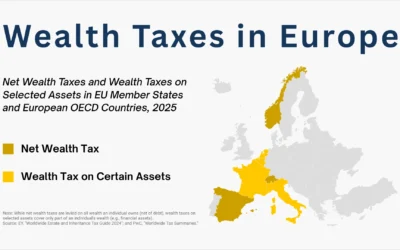

Wealth Taxes: Leveling the Field or Stifling Growth?

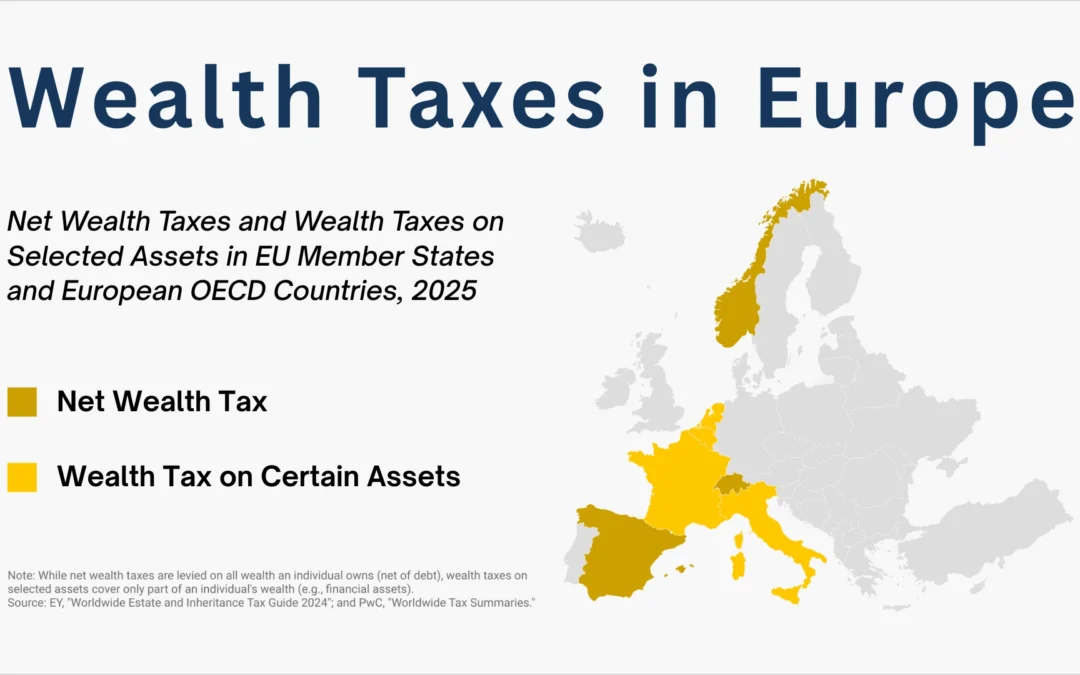

Currently, three European nations, including Switzerland, impose a net wealth tax. Which other countries have a net wealth tax? Additionally, what countries levy a wealth tax specifically on certain assets?

Could the United States be the Next Global Tax Haven?

When one thinks of tax havens, Bermuda, the Cayman Islands, and Switzerland will often come to mind. These countries are some of the most well-known examples of tax havens—countries or independent areas where taxes are levied at zero or a very low rate. But are recent proposals to lower taxes and decrease transparency turning the United States into the next global tax haven?

Navigating Tax Changes in 2025 Amid Uncertainty

2025 was set up to be a significant year for global tax updates—most notably the continued implementation of Pillar Two, the global tax agreement designed by the OECD. And in December, the list of countries that have introduced Pillar Two rules, or that have committed to doing so, grew…

Tax Cliffs and a Second Trump Presidency

The Tax Cuts and Jobs Act of 2017 introduced significant tax cuts during President Donald Trump’s first term. However, many provisions are set to expire at the end of 2025, which could lead to a “tax cliff” for individuals, families and businesses.

Wealth Taxes: Leveling the Field or Stifling Growth?

Currently, three European nations, including Switzerland, impose a net wealth tax. Which other countries have a net wealth tax? Additionally, what countries levy a wealth tax specifically on certain assets?

Could the United States be the Next Global Tax Haven?

When one thinks of tax havens, Bermuda, the Cayman Islands, and Switzerland will often come to mind. These countries are some of the most well-known examples of tax havens—countries or independent areas where taxes are levied at zero or a very low rate. But are recent proposals to lower taxes and decrease transparency turning the United States into the next global tax haven?

Navigating Tax Changes in 2025 Amid Uncertainty

2025 was set up to be a significant year for global tax updates—most notably the continued implementation of Pillar Two, the global tax agreement designed by the OECD. And in December, the list of countries that have introduced Pillar Two rules, or that have committed to doing so, grew…

Tax Cliffs and a Second Trump Presidency

The Tax Cuts and Jobs Act of 2017 introduced significant tax cuts during President Donald Trump’s first term. However, many provisions are set to expire at the end of 2025, which could lead to a “tax cliff” for individuals, families and businesses.

Beyond Borders: Implications of Recent Court Cases on Foreign Tax Issues

Foreign trusts, foreign ownership. The rules governing the legal structure of trusts and their associated obligations are complex, and some of these rules aren’t fully defined in the tax law…

Navigating the Global Tax Landscape in 2024 – Third Quarter Roundup

It’s been a busy year for global tax issues, between the Global Minimum Tax, worldwide calls for a wealth tax, and significant judicial decisions in the United States…

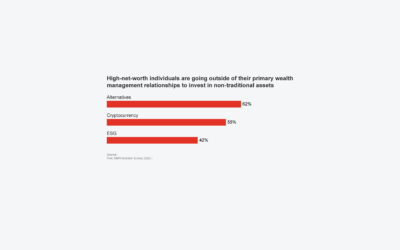

High-Net-Worth Individuals Look to Expand Their Investments

High-net-worth and ultra-high-net-worth individuals are increasingly going outside their primary wealth management relationships to invest in alternative investments, cryptocurrencies, and ESG, according to a survey by PWC.

The Impact of the Global Minimum Tax on Corporate Flows

Is this the end of shifting profits from high-tax to low-tax jurisdictions?

The landscape of international taxation is undergoing a seismic shift with the implementation of the Organization for Economic Co-operation and Development’s (OECD) Global Minimum Tax (GMT).

Redefining the 16th Amendment: The Impact of the Mandatory Repatriation Tax on Ultra High Net Worth Clients

How has a relatively minor tax bill — $14,729 to be exact — turned into one of the most important tax cases for the United States? The matter at hand is whether the United States federal government can tax unrealized gains as income in Moore v. United States (Docket 22–800)…

IRS: Partial Penalty Relief Still Available for 2019 and 2020 Returns, But it Depends…

Amidst the upheaval of the COVID-19 pandemic, some U.S. taxpayers were unable to file their 2019 or 2020 income tax returns within the IRS’ filing deadlines The Internal Revenue Service, in a show of understanding, fully waived penalties for individual taxpayers and businesses who filed certain late returns by September 30, 2022.

GRA drags 48 businesses to court …over tax evasion, failure to issue VAT invoices for goods, services

Who needs to file fbar About 48 businesses are currently undergoing prosecution for evading taxes and failing to issue Value Added Tax (VAT) invoices on purchase of goods and...

Heres Why The Bahamas Are An In-Demand Choice For Luxury U.S. Buyers

Foreign tax credit MAISON Bahamas, the leading luxury brokerage throughout the Bahamas, dives into the latest on the ... [+] luxury real estate market. MAISON BahamasFrom Nassau...

Queensland land tax: Media Watch’s false impression on Queensland land tax coverage

Us trust private client advisor Updated Oct 4, 2022 – 2.55pm, first published at 2.14pmViewers of the ABC’s Media Watch on Monday night were given the impression that...

IRS New JSEIT Unit Will Use Crowdsourcing, Cooperative Intra-Agency Intelligence and Media Alerts to Quash Emerging Tax Fraud Schemes

Announced in June, the Joint Strategic Emerging Issues Team, or JSEIT, combines expertise from units across the agency, including Criminal Investigation, Tax Exempt/Government Entities, Large Business & International, and Small Business/ Self Employed.

Spain deliberates ‘digital nomad’ visa programme for remote workers

Cfc repatriation tax A representational image of a remote worker typing on a laptop. — Pexels/FileSpain is deliberating to issue ‘digital nomad’ visas providing...

Open up, it’s the IRS. We’re here about the crypto tax you dodged

Us trust private client advisor The IRS has been granted a court order to collect records from a bank the agency said will help it identify US taxpayers who failed to report...

Jack Brister Featured in Live Event: Estate Planning and Investment Strategies for Multi-Nationals on Oct. 25, 2022

Complex Tax and Non-Tax Issues. Trust and estate planning and investment strategies for multinationals is a complex topic about which International Wealth Tax Advisors founder Jack Brister has encyclopedic knowledge.

International Tax Roundup: Third Quarter 2022

2022 has been an unpredictable year amidst soaring inflation and geopolitical unrest. In the tax realm, governments have been trying to hedge against this uncertainty by shoring up their budgets and addressing inconsistent tax enforcement.

The Supreme Court Gets a Chance to Revisit America’s Imperialist Past

Us trust private client advisor Who gets to be a U.S. citizen at birth? This question is fairly simple when asked almost anywhere in the United States. If you are born on U.S....

Australian Tax Office is the benchmark in how to build a modern data organisation

Cross border tax advice “Computers don’t get tired,” notes Marek Rucinski, the head of data and analytics at the ATO.The ATO has more than 150 AI applications...

King Charles III won’t have to pay inheritance tax

International tax consultant In the wake of Queen Elizabeth II's death last Thursday, King Charles III inherited a realm of wealth and he doesn't have to pay inheritance tax on...

Why King Charles won’t have to pay inheritance tax on Duchy of Lancaster estate

Fatca filing King Charles III can avoid paying millions in inheritance tax on the Duchy of Lancaster estate due to an old rule designed to protect the Royal Family's wealth. His...

Thousands of Irish families to benefit as Taoiseach reveals ‘no appetite’ to make major tax change

What is a foreign trust THE government will not inflict more misery on struggling families by imposing extra tax on the amount of money parents can leave their children when they...

Americans Spend More on Taxes Than Food, Clothing, Health Care COMBINED…

Non resident alien tax withholding (Photo by Zach Gibson/Getty Images) (CNSNews.com) - According to newly released data from the Bureau of Labor Statistics, Americans in 2021...

Recommendation to increase take from wealth, property and inheritance taxes

Offshore trusts inheritance tax Sources say the report notes property, land, capital gains and capital acquisitions — which taxes inheritance — as areas where the...

Italian elections: What are the main parties’ policies for foreigners?

Us gaap revenue recognition Checking if the site connection is secure www.thelocal.it needs to review the security of your connection before proceeding. Read moreThis news is...

Liz Truss Considers Cutting VAT to 15% to Ease UK Crisis: Telegraph

Global intangible low taxed income Liz Truss is considering cutting Britain’s VAT sales tax by as much as 5 percentage points across the board, the Telegraph reported, a...

Will China’s bubble finally burst?

Non resident alien tax withholding Below is a complete transcript of the Sinica Podcast with Tom Orlik. Kaiser Kuo: Welcome to the Sinica Podcast, a weekly discussion of current...

Personal Finance Daily: Mortgage rates dip slightly due to cooling inflation data, but new construction slows and Inflation Reduction Act promises tax credits for new and used electric vehicles — here’s how to claim them

Us trust private client advisor Hi, MarketWatchers. Don’t miss these top stories.Let’s Take a Look Inside Serena Williams’ Smashing Homes Tennis great Serena...

Energy & Environment — Manchin works on Sinema for climate, tax deal

Us inheritance tax for non us citizens Sens. Joe Manchin (D-W.Va.) and Krysten Sinema (D-Ariz.) are in discussions over a climate and tax package, while the Biden administration...