IWTA Services

FOREIGN TRUST, ESTATE AND GIFT

TAXATION

IWTA provides strategic consulting and assists in selecting and implementing a wealth transfer structure based on clients’ jurisdiction and current needs. We prepare the proper disclosures and tax returns for each circumstance to ensure returns are filed as dictated by U.S. policies and regulations.

It is not uncommon for clients and even their legal advisors to be under-informed in regards to the complex laws and reporting requirements of Foreign Trusts and Foreign Non-Grantor Trusts. What you don’t know can cost you dearly. Click below to learn more about FBAR, required forms and classifying your Foreign Trust.

PRE-IMMIGRATION AND EXPATRIATION PLANNING

IWTA assists clients planning to become U.S. taxpayers as well as those terminating their citizen or green card status. We help mitigate the substantial taxes that can result from these decisions.

If you’re a non-resident alien, have business activities or holdings in the U.S., or just visit a lot, Uncle Sam doesn’t need to wait until you seek permanent status to collect taxes. Lack of understanding of the rules can be costly.

If you’re a U.S. citizen or resident alien that has decided to expatriate,Uncle Sam has a parting gift: exit tax. Expatriation is a complicated affair. Before you make this life-changing decision, be aware of all the rules and consequences. Click below for an overview and learn how IWTA can help.

U.S. REAL ESTATE AND FOREIGN INVESTMENTS

What is FIRPTA and why should you care? The Foreign Investment in Real Property Tax Act (FIRTPA) was passed into law by the U.S.Congress in 1980. Since then, FIRPTA has gone through significant revisions, affecting foreign investors, foreign trusts, gifts, REITS, and more.

For U.S. taxpayers: IWTA provides strategic consulting and tax strategies for foreign investments. For non-U.S. taxpayers: IWTA provides diligent assessment of and planning for investments in U.S. business and real estate.

Click below to get an overview of FIRTPA and how it may apply to your investment situation.

NON-RESIDENT ALIEN TAX PLANNING

Did you know you were being tested? If you are a non-resident alien (NRA), the U.S. government may decide to treat you as a tax-paying resident based on the “alien presence test”. And, even if you fail the “test”, individual U.S. States can impose their own set of criteria.

NRAs and foreign investors need smart strategies and investment structures to minimize U.S. tax exposure. IWTA can help!

Click below to get a better understanding of non-resident alien tax rates and rules.

VOLUNTARY DISCLOSURE

Lack of foreign financial asset reporting can accrue over time due to erroneous advice, taxpayer oversight or personal issues. The penalties can be severe, even if the assets themselves are modest.

The U.S. federal and state governments have long-standing policies of offering voluntary disclosure programs and initiatives for both individual and business taxpayers. IWTA helps taxpayers navigate that haven’t filed U.S. income tax returns or all appropriate international disclosures navigate the system, file the appropriate documents, and get back in compliance.

Click below for the low down on the Foreign Account Tax Compliance Act (FACTA) and Voluntary Disclosure.

FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA)

If you’re a U.S. citizen with foreign investments, trusts or accounts, thanks to FACTA, which enlists the cooperation of international banks and financial institutions, your holdings have been reported to the IRS. Failure to file the required documents can result in sizeable penalties, even if the investment itself or income gained is negligible. Resident aliens with foreign investments and foreign-owned entities organized under U.S. law are also subject to FACTA reporting.

IWTA helps clients find the right classification for their entities, obtain a Global International Identification Number, and prepare Form W-8 and Form 8965 to ensure compliance.

Click the button below to learn more salient facts about FACTA.

BUSINESS ACTIVITIES

Did you know?: A physical business presence is not necessary for the U.S. government to impose taxes and demand filings of a foreign-held business. State and Local governments are ready to collect as well. Foreign owners of single member LLCs are also subject to reporting requirements — even if the income source is outside of the U.S.

IWTA helps clients establish businesses in the U.S.A., structure them for maximum tax benefits, and file business tax returns as U.S. policies and regulations dictate.

Click the button below for more information on State and Local Tax laws, the Branch Profit Tax, SMLLCs, and how U.S. Estate and Gift Tax and Inheritance Tax for non-U.S. citizens affect business strategy.

FOREIGN ASSETS AND FBAR REPORTING

What constitutes having a financial interest in a foreign account or asset is surprisingly far-reaching, according to the Internal Revenue Service and U.S. tax law. And, citizens are required to report their holdings. Filing applies whether the U.S. citizen lives in country or abroad.

IWTA’s U.S. clients with foreign assets are kept in compliance with the filing of Foreign Bank Account Reports (FBARs). Even small omissions can lead to substantial penalties!

Click the button below to learn more details on FinCEN and FBAR filing.

Get the peace of mind that comes with putting your U.S. business and investment tax affairs in our hands!

Read Expert Tips and Coverage of News & Laws

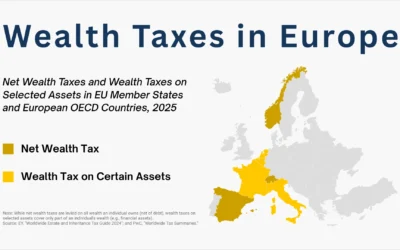

Wealth Taxes: Leveling the Field or Stifling Growth?

Currently, three European nations, including Switzerland, impose a net wealth tax. Which other countries have a net wealth tax? Additionally, what countries levy a wealth tax specifically on certain assets?

Could the United States be the Next Global Tax Haven?

When one thinks of tax havens, Bermuda, the Cayman Islands, and Switzerland will often come to mind. These countries are some of the most well-known examples of tax havens—countries or independent areas where taxes are levied at zero or a very low rate. But are recent proposals to lower taxes and decrease transparency turning the United States into the next global tax haven?

Navigating Tax Changes in 2025 Amid Uncertainty

2025 was set up to be a significant year for global tax updates—most notably the continued implementation of Pillar Two, the global tax agreement designed by the OECD. And in December, the list of countries that have introduced Pillar Two rules, or that have committed to doing so, grew…