The Wild West of Bank and Finance Laws

Do you get a lot of credit card offers in the mail from banks you’ve never heard of? Chances are, the bank’s HQ is in, you guessed it, South Dakota. Flip over a few credit cards in your wallet and read the fine print. Why set up an issuing bank in South Dakota? In 1981, the state abolished laws limiting the interest rate on credit cards. South Dakota is home to the big sky, (sorry, Montana) and the sky’s the limit when it comes to interest rates on your Visa or Mastercard.

In 1983, South Dakota was the first state to establish perpetual trusts. In a nutshell, perpetual trusts allow monies to remain in place for generations, with no one having to pay inheritance taxes.

Trusts are wealth structures favored by high-net-worth families and individuals, and South Dakota has a history of legislating highly favorable laws for settlors and trustees. The sweet green icing on the money layer cake is no income tax, no capital gains tax and no inheritance tax. The cherry on top are laws that ensure the investor of extreme privacy and secrecy from any blue and brown suits that may try to penetrate their personal Fort Knox. Assets held in South Dakota trusts have increased from 57 billion to $360 billion in the last 10 years.

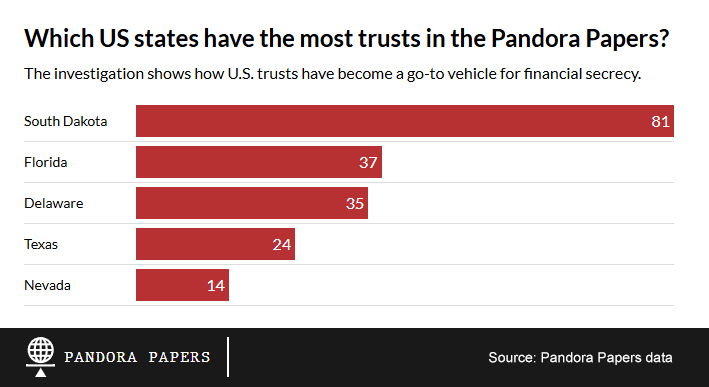

According to the Pandora Papers, among South Dakota’s wealthy foreign opt-ins are Ecuador’s President Guillermo Lasso, Chinese real estate billionaire Sun Hongbin, and Guatemalan industrial products titan Federico Kong Vielman.

IWTA founder Jack Brister weighs in: “Though it is true that South Dakota, along with Wyoming, have strong state-level asset privacy laws, it should be known that these laws don’t allow U.S. or international persons a means of U.S. tax avoidance.

U.S. persons are always subject to U.S. tax no matter where they reside or where their assets are located. Trustees are held liable for the appropriate tax reporting and payment of tax due and no state law can remove these federally-mandated responsibilities.

The skinny on the matter is that the U.S.-legislated law in which the premise is a trust, even those established under U.S. law, are foreign trusts unless specific criteria are met. The purpose for enacting such a broad definition of what a foreign trust is was to cast a wide net to ensure U.S. persons could not use such structures to avoid their tax responsibilities without facing severe penalties. In doing so, the U.S. limited its ability to tax trusts established in the U.S. by foreign persons where the trust had no U.S. assets or income and the beneficiaries were not residing in the U.S.

This is because the U.S. has no authority to tax foreign persons if they are not deemed to be U.S. residents and have no U.S. assets or income. Reminder: capital gains and most interest income are tax-exempt. Business income and real property gains are subject to taxation.

These rules apply equally to a foreign trust. Therefore, when a trust is established under state law where the primary fiduciary responsibilities are with a foreign person and not the U.S. trustee (generally a U.S. trust company), and the trust has no U.S.- sourced income, the trust treated as a foreign person, which means there is insufficient nexus to the U.S., resulting in the U.S. having no legal taxing authority.”