Led by International Tax Consultant Jack Brister, the IWTA team excel at solving complex cross border tax issues. Working with clients’ offshore and domestic wealth structures and investment portfolios, we strategically pinpoint the intricacies and weaknesses of U.S. and foreign tax systems to minimize loss of wealth and profits.

Founded in 2015 and located in the heart of New York City on Avenue of the Americas, International Wealth Tax Advisors provides highly personalized, secure and private global tax accounting and consulting to individuals, families, family offices and foreign-based multinational business clients across the U.S.A and North America, Europe, South America, Asia, Africa, Australia and the Middle East.

SERVICES

Our Specialties

Foreign Trust, Estate and Gift Taxation

Based on clients’ jurisdiction and current needs, IWTA provides strategic consulting and assists in selecting and implementing a wealth transfer structure to maximize returns and minimize tax exposure.

Pre-Immigration and Expatriation Planning

IWTA assists clients planning to become U.S. taxpayers as well as those terminating their citizen or green card status. We help mitigate the substantial taxes that can result from these decisions.

U.S., Real Estate & Foreign Investments

IWTA provides non-U.S. taxpayers diligent assessment of and planning for investments in U.S. business and real estate. For U.S. taxpayers: We provide foreign investment and tax strategies.

Foreign Financial Asset and FBAR Reporting

Get help with FACTA, foreign financial asset reporting and the FBAR and know the filing requirements: Most U.S. persons with interest in foreign accounts/investments are required to report, and to file the FBAR.

Voluntary Disclosures

The U.S. federal and state governments have long-standing offerings of voluntary disclosure programs. IWTA helps taxpayers who have lapsed in tax filing and international disclosures get back in compliance.

Business Activities

IWTA helps clients establish businesses in the USA, structure them for maximum tax benefits, and file tax returns as U.S. policies and regulations dictate. Knowing and complying with U.S. State and Local tax laws are critical factors.

Foreign Account Tax Compliance Act (FATCA)

IWTA helps clients find the right classification for their entities, obtain a Global International Identification Number, and prepare Form W-8 and Form 8966 to ensure compliance.

Non-Resident Alien Tax Planning

The time NRAs spend in the U.S., combined with U.S. investment structure is critical to minimize U.S. tax exposure and liability. IWTA helps NRAs avoid costly mistakes with a personalized strategic financial and tax plan.

The U.S. is the world's largest economy with vast opportunities to expand wealth.

The “American Dream” of building unlimited wealth through investments in the U.S.A is practically a global obsession. However, understanding the U.S. system of worldwide tax collection and what legally defines an entity as a U.S. taxpayer is critical to building, growing and keeping your investments.

IWTA’s Guiding Values:

We are guided by these values and pledge our commitments in service to our clients.

Integrity

Authenticity

Tenacity

Security and Confidentiality

Add Substantive Value in all we Do

KNOWLEDGEABLE

Get Up to Date Information

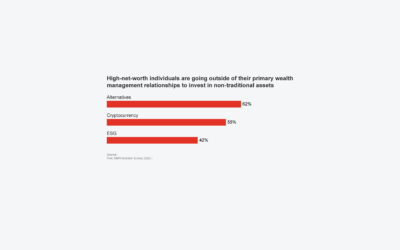

High-Net-Worth Individuals Look to Expand Their Investments

High-net-worth and ultra-high-net-worth individuals are increasingly going outside their primary wealth management relationships to invest in alternative investments, cryptocurrencies, and ESG, according to a survey by PWC.

The Impact of the Global Minimum Tax on Corporate Flows

Is this the end of shifting profits from high-tax to low-tax jurisdictions?

The landscape of international taxation is undergoing a seismic shift with the implementation of the Organization for Economic Co-operation and Development’s (OECD) Global Minimum Tax (GMT).

Redefining the 16th Amendment: The Impact of the Mandatory Repatriation Tax on Ultra High Net Worth Clients

How has a relatively minor tax bill — $14,729 to be exact — turned into one of the most important tax cases for the United States? The matter at hand is whether the United States federal government can tax unrealized gains as income in Moore v. United States (Docket 22–800)…

IRS: Partial Penalty Relief Still Available for 2019 and 2020 Returns, But it Depends…

Amidst the upheaval of the COVID-19 pandemic, some U.S. taxpayers were unable to file their 2019 or 2020 income tax returns within the IRS’ filing deadlines The Internal Revenue Service, in a show of understanding, fully waived penalties for individual taxpayers and businesses who filed certain late returns by September 30, 2022.

GRA drags 48 businesses to court …over tax evasion, failure to issue VAT invoices for goods, services

Who needs to file fbar About 48 businesses are currently undergoing prosecution for evading taxes and failing to issue Value Added Tax (VAT) invoices on...

Heres Why The Bahamas Are An In-Demand Choice For Luxury U.S. Buyers

Foreign tax credit MAISON Bahamas, the leading luxury brokerage throughout the Bahamas, dives into the latest on the ... [+] luxury real estate market. MAISON...